If you’re a homeowner in need of credit, borrowing against your home’s equity can be a great option. A home equity loan and a home equity line of credit (HELOC) are both designed to give you affordable access to credit by tapping into the money you’ve already invested in your home. The possibilities for how to use that equity, however, can extend beyond the home.

The highlights:

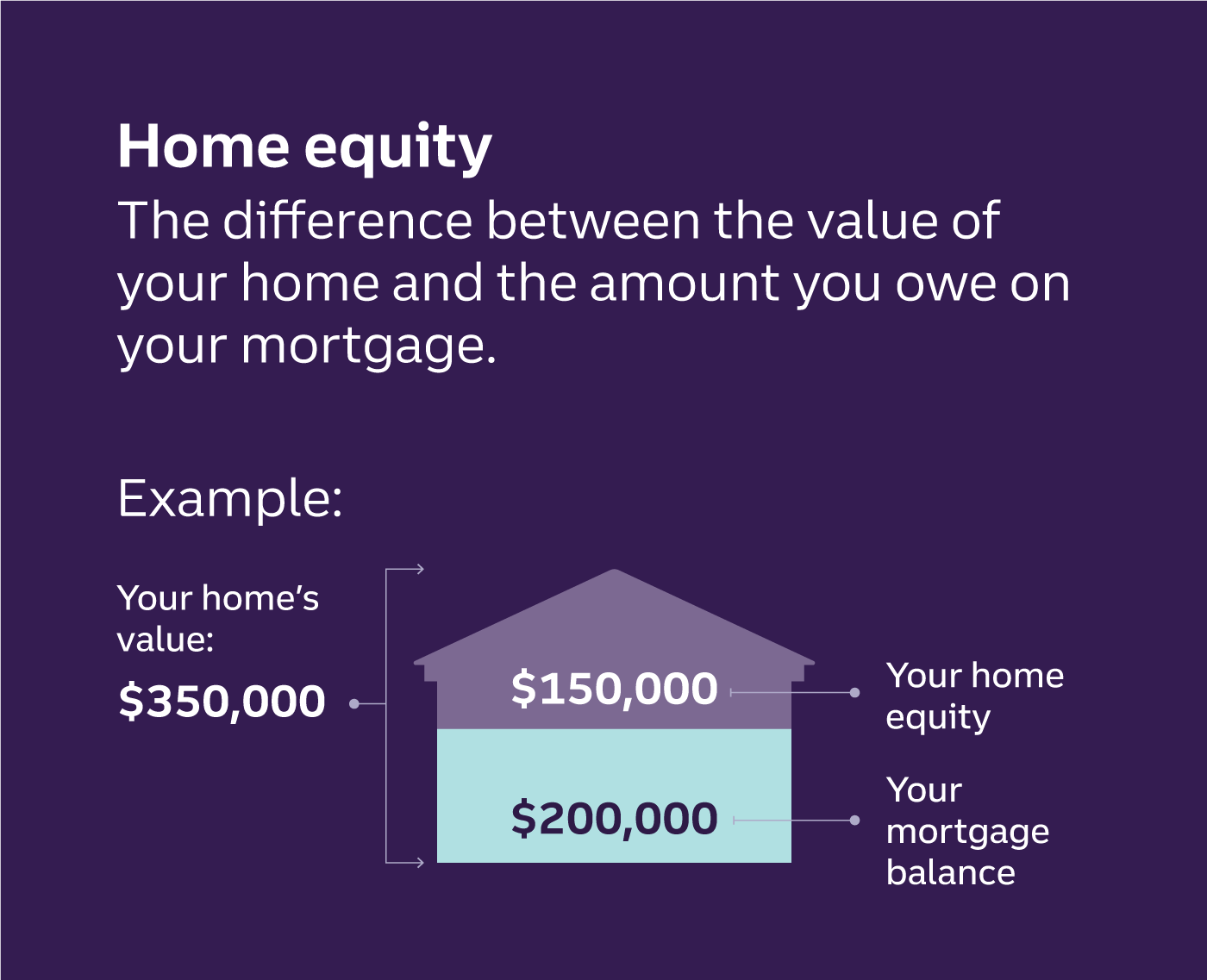

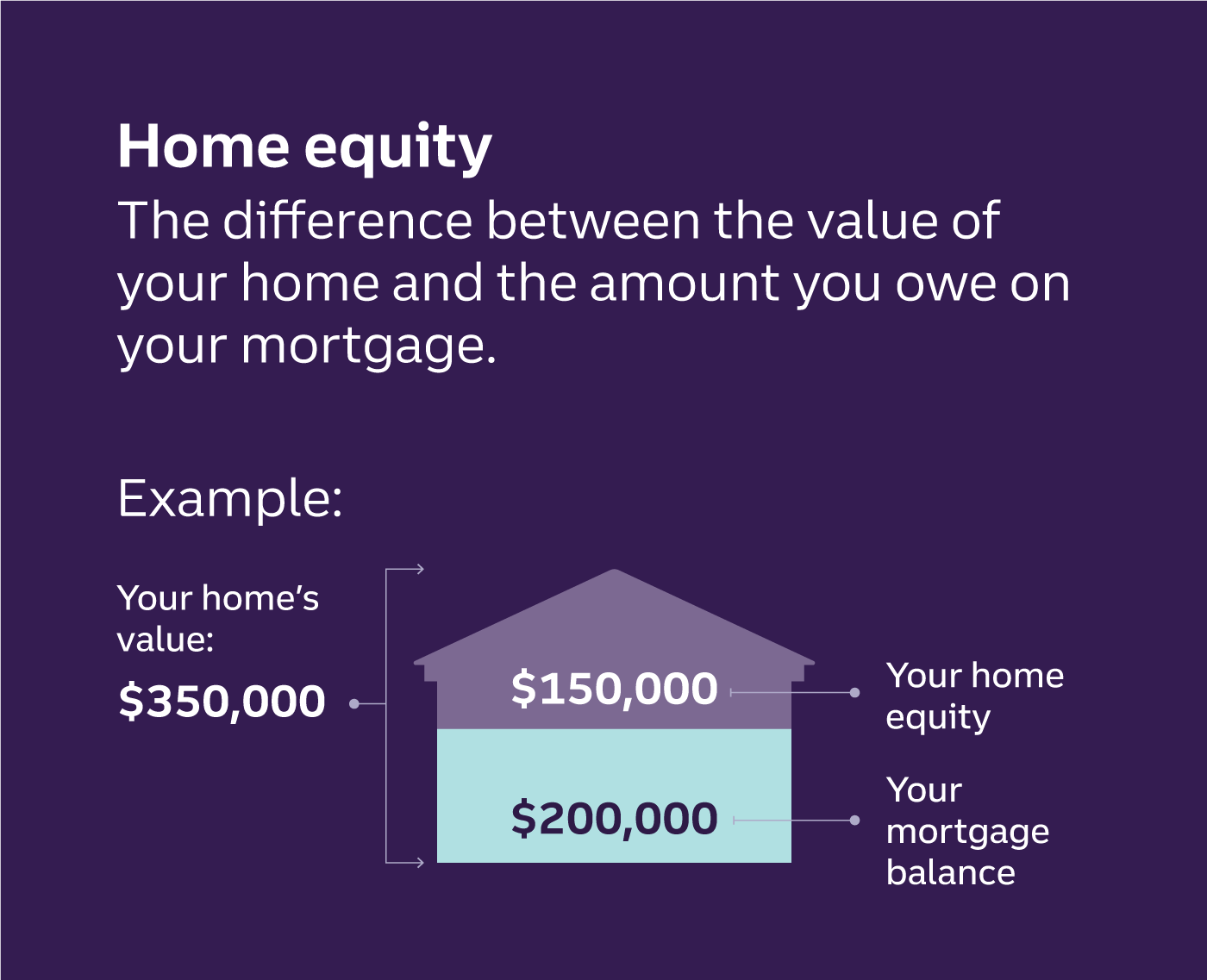

Simply put, home equity means your property is worth more than you owe on it. Brian Ford, Head of Financial Wellness at Truist, calls home equity the “magic number.”

“I think home equity is one of the best ways to build wealth,” says Ford. “It happens magically when you make your monthly mortgage payments on time and your home’s value appreciates.”

To estimate your home equity, subtract your mortgage balance from your home’s market value—the amount you could sell it for today. If you don’t know your home’s value, you can check out estimates from online realty sources. It won’t be as accurate as a home appraisal, but it’s a good place to start.

Once you have an idea of how much equity you may have, you can decide if it could be enough to cover your needs. Keep in mind, though, that most lenders only allow you to borrow up to 80% of your home equity Disclosure 2 .

Here are three common reasons homeowners get a home equity loan or line of credit:

“Improving your home can improve your everyday life and standard of living, while also increasing the value of your property. I love anything that we can get value out of that benefits our lifestyles at the same time.” —Brian Ford, head of Financial Wellness, Truist

What’s the difference between a home equity loan and a HELOC?

How does a home equity loan work? Homeowners often use one-time home equity loans to finance planned expenses. Similar to a personal loan, you could borrow a lump sum with a fixed interest rate, fixed monthly payments, and a scheduled pay-off date. Often called a second mortgage, a home equity loan won’t remove your first mortgage—it stays in place, and you’ll make payments on both loans. A home equity loan is a good choice if you know exactly how much you need to borrow.

How does a HELOC work? Because a HELOC is a line of credit, you’ll have more flexibility around how much credit you use and when you use it. Like a credit card, your available credit will replenish up to the original credit limit as you repay what you’ve borrowed. HELOCs often come with variable interest rates, so your payment could go up or down based on your rate and how much credit you’ve used.

It’s important to be careful not to misuse the line of credit, just like with a credit card. Manage a HELOC responsibly to ensure it serves you in a way that improves your financial confidence and well-being.

If you’ve built up enough equity in your home to borrow against it, that’s a financial milestone worth celebrating. But just because you can do something doesn’t necessarily mean you should. Since these forms of credit are backed by the money you’ve invested in your home, it’s generally best to stay away from tapping your home equity for one-time events like weddings, vacations, or items that depreciate in value.

If you’re considering using home equity for anything other than home repairs, improvements, or consolidating higher-interest debt, take some time to reflect to decide if what you’re borrowing for is really worth it. And if you do decide to borrow, be sure to budget for your monthly payments and have a payoff plan in place first.

“It’s a matter of balancing what you value against the numbers and the risks,” says Bright Dickson, co-host of the Money and Mindset podcast.

The application process will be similar for both a home equity loan and HELOC. You’ll likely need to provide the lender with bank account statements, proof of income, tax statements, and permission to check your credit history and credit score. A home appraisal or valuation may also be required. Both types of credit may come with closing costs, too.

Interest rates and terms will vary based on your situation and credit history. To improve your chances of being approved and getting favorable terms—which will effectively lower the cost of borrowing—pay attention to these stats.

How your home equity grows

The principal you owe on your mortgage goes down. Simply making your monthly mortgage payment will make this happen. If it’s in your budget to pay a little extra toward your principal each month, your loan balance will fall faster.

Home values go up. Barring any major economic downturns, the market value of your home may naturally increase over time. The good news if you’ve been a homeowner for a while: Home values have been on the upswing. In fact, the Federal Housing Finance Agency says the percentage of homes with 30% equity or higher (what the agency considers “high equity”) reached a 10-year high of 83.3% in Q1 2023. Disclosure 3

Next step suggestions:

This content does not constitute legal, tax, accounting, financial, investment, or mental health advice. You are encouraged to consult with competent legal, tax, accounting, financial, investment, or mental health professionals based on your specific circumstances. We do not make any warranties as to accuracy or completeness of this information, do not endorse any third-party companies, products, or services described here, and take no liability for your use of this information.

No card error message

Disclosure 3 “Homeowners’ Equity Remains High,” Federal Housing Finance Agency, August 31, 2023.

Truist Bank, Member FDIC. © 2024 Truist Financial Corporation. Truist, the Truist logo and Truist Purple are service marks of Truist Financial Corporation.

Equal Housing Lender

Services provided by the following affiliates of Truist Financial Corporation (Truist): Banking products and services, including loans and deposit accounts, are provided by Truist Bank, Member FDIC. Trust and investment management services are provided by Truist Bank, and Truist Delaware Trust Company. Securities, brokerage accounts and /or insurance (including annuities) are offered by Truist Investment Services, Inc., which is a SEC registered broker-dealer, member FINRA, SIPC, and a licensed insurance agency. Investment advisory services are offered by Truist Advisory Services, Inc., GFO Advisory Services, LLC., each SEC registered investment advisers.

Mortgage products and services are offered through Truist Bank. All Truist mortgage professionals are registered on the Nationwide Mortgage Licensing System & Registry (NMLS), which promotes uniformity and transparency throughout the residential real estate industry. Search the NMLS Registry.

Comments regarding tax implications are informational only. Truist and its representatives do not provide tax or legal advice. You should consult your individual tax or legal professional before taking any action that may have tax or legal consequences.

"Truist Advisors" may be officers and/or associated persons of the following affiliates of Truist, Truist Investment Services, Inc., and/or Truist Advisory Services, Inc. Truist Wealth, International Wealth, Center for Family Legacy, Business Owner Specialty Group, Sports and Entertainment Group, and Legal and Medical Specialty Groups are trade names used by Truist Bank, Truist Investment Services, Inc., and Truist Advisory Services, Inc.

Truist Securities is a trademark of Truist Financial Corporation. Truist Securities is a trade name for the corporate and investment banking services of Truist Financial Corporation and its subsidiaries. All rights reserved. Securities and strategic advisory services are provided by Truist Securities, Inc., member FINRA and SIPC. Lending, financial risk management, and treasury management and payment services are offered by Truist Bank. Deposit products are offered by Truist Bank.

Applications, agreements, disclosures, and other servicing communications provided by Truist Bank and its subsidiary businesses will be provided in English. As a result, it will be necessary for customers to speak, read and understand English or to have an appropriate translator assisting them. Truist offers the following resources for consumers that have Limited English Proficiency:

Translation or other language access services may be available. When calling our office regarding collection activity, if you speak a language other than English and need verbal translation services, be sure to inform the representative. A description and translation of commonly-used debt collection terms is available in multiple languages at http://www.nyc.gov/dca.